THE landed home segment has staged a positive recovery after being in the doldrums for the past four years.

According to URA Realis caveats data, the number of caveats lodged for landed homes rose 145 per cent from 968 in 2014 to 2,369 in 2017.

While prices have been dragged down by the implementation of the Total Debt Servicing Ratio (TDSR) framework and poor market sentiments since 2014, the average selling price of strata landed houses and land-titled houses have recovered to their 2015 levels, at S$805 per sq ft (psf) and S$1,290 psf respectively in January 2018.

Strata landed housing developments have been gaining popularity in recent years, especially among families with young children.

They are allowed within landed housing estates including Good Class Bungalow areas. They offer home buyers a housing option that combines landed housing living with communal facilities and greenery such as those available in private condominiums.

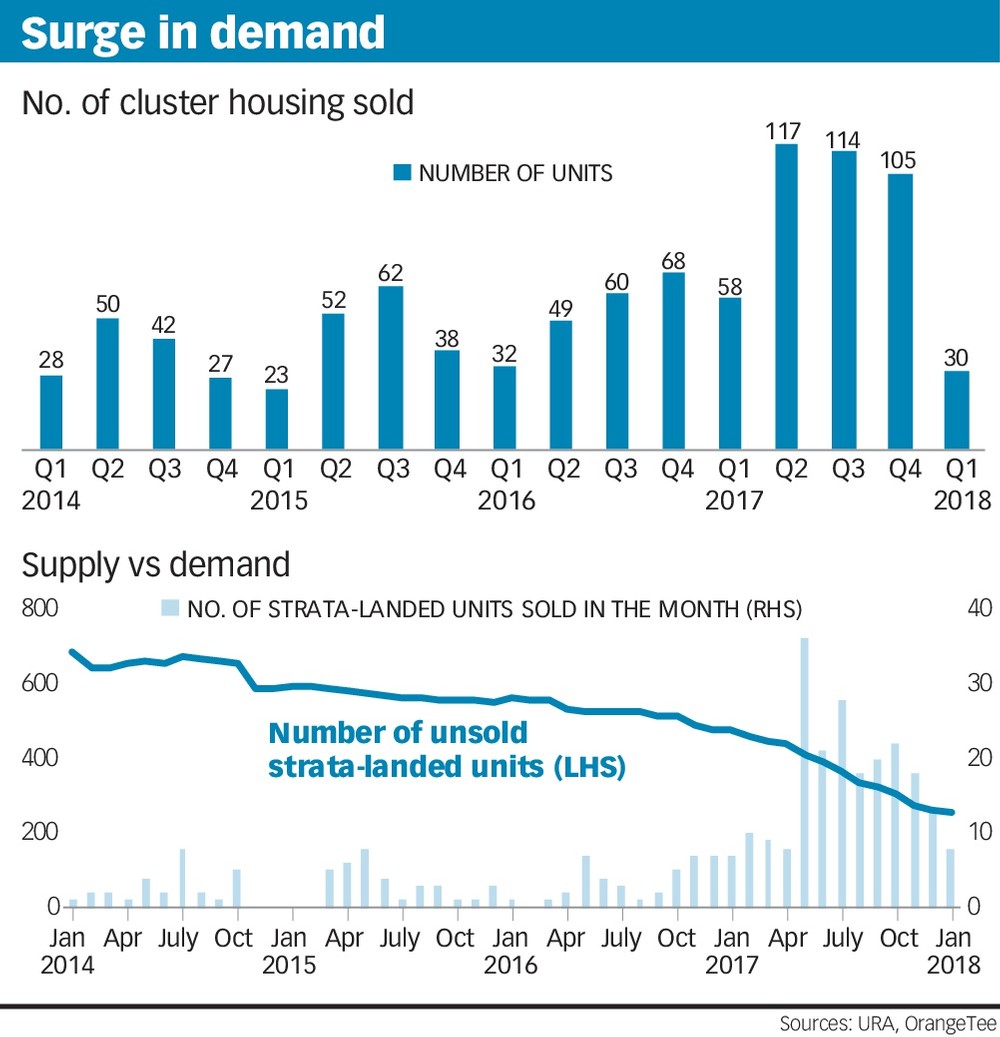

Since the peak in 2011, transactions for strata landed houses have been heading south, but demand has steadily recovered after bottoming out in 2014. Sales of strata landed houses rose 168 per cent from 2014 to 2017, a higher increase than land titled houses (141 per cent).

The number of such units sold in 2017 is also at its highest level (394 units) since the introduction of the TDSR, registering more than 100 units per quarter over the last three quarters.

The top-selling cluster housing developments in 2017 include Belgravia Villas with 63 units sold. This is followed by Watercove (39 units), The Shaughnessy (17 units) and One Surin (15 units).

Why are such properties enjoying renewed interest and should you consider buying one?

Appeal of cluster houses

The hefty price tag of land titled properties breaches the affordability of most buyers. In Q4 2017, the average price of a freehold strata terrace house was S$817 psf, as compared to S$1,417 psf for a freehold land titled terrace house.

Of the newer (10 years or less) land titled houses which changed hands between 2013 and 2017, fewer than 10 were transacted at S$2 million and below. Comparatively, about 50 strata landed houses were sold over the same period.

Even with the TDSR, a measure meant to discourage buyers from overstretching their affordability through large loans, cluster houses are still significantly cheaper than land titled houses.

Cluster houses have demonstrated the ability to garner higher yield during an upmarket as they can command almost equivalent rentals to land houses at a lower cost. Homeowners may also expect their home values to hold up better than condominiums in the long run due to their limited supply.

As such, cluster houses will remain attractive to buyers with stronger financial capacity, especially condo upgraders and en bloc buyers. They would also appeal to HDB upgraders who may consider this class of property a faster upgrade than condominiums, but at a more affordable price than land titled houses.

Limited supply preserves exclusivity

Demand for cluster housing has been rising due to a dearth of new launches in recent years. From 2015, the annual cluster home supply has dwindled below the 10-year average of 200 units. In 2014, no new cluster housing projects was introduced.

Subsequently, only five projects yielding 107 units were added into the market between 2015 and 2017. This pales in comparison to the 896 units yielded from 26 cluster housing projects between 2010 and 2014.

According to the URA's monthly developers' survey figures, the unsold stock as of January 2018 is also at the lowest level seen since 2014.

The number of units sold per month has also increased substantially over the last nine months. This may indicate that demand for cluster housing is currently outpacing supply.

The supply crunch is set to worsen in the coming months. In 2014, URA revised the development guidelines for strata landed housing developments such that developers must set aside at least 45 per cent of the land area for communal open space, up from the previous 30 per cent.

Of this, a minimum of 25 per cent has to be set aside for on-ground greenery while up to 20 per cent can be used for communal facilities such as swimming pools and playgrounds. The number of cluster houses to be built will probably fall further as the revised guidelines will inevitably affect developers' profit margins.

Outlook

The limited supply of cluster houses will preserve the value of such properties, making them even more exclusive and rare. With their attractive price tag and good capital yield, demand for cluster houses will likely rise in the coming months.

The growing number of en bloc deals will likely have a positive impact on cluster housing demand. With the collective sales of close to 35 projects (on sites that were zoned residential or with residential component) being completed recently, an estimated 4,500 residential homes would be displaced from these projects.

The sales proceeds that each owner is expected to receive can amount to a windfall of S$2-3 million, well within the price range of most cluster houses. In addition, these enbloc owners, who are used to large living spaces, would find cluster housing a more attractive option than condominiums.

As demand is likely to pick up further, we can expect prices to climb by 3 to 5 per cent this year, barring any unforeseen events.

- Ms Sun is head of research & consultancy and John Tay, a research analyst, at OrangeTee & Tie