By Fiona Ho / EdgeProp | October 8, 2018 12:58 PM MYT

The total number of Good Class Bungalow transactions in 2018 stood at 39 as at end-November. Leong Boon Hoe, chief operating officer of List Sotheby’s International Realty Singapore (List SIR), expects the full-year figure to match the 42 deals last year.

GCB sales surged from 25 deals in 2014 to 32 in 2015. While the sales dipped slightly in 2016 to 29, they rose sharply to 42 last year. Leong attributes the strength of the GCB market to the profile of the owners and buyers: ultra-high-net-worth (UHNW) individuals with strong financial backing who are also long-term property investors.

While the property cooling measures implemented in July have brought about a “wait-and-see approach” among most property buyers, the niche group of GCB buyers is less affected, says Leong. Their buying decisions are not limited to affordability but are instead based on whether “the property fits their needs, objectives and fancy”, he says.

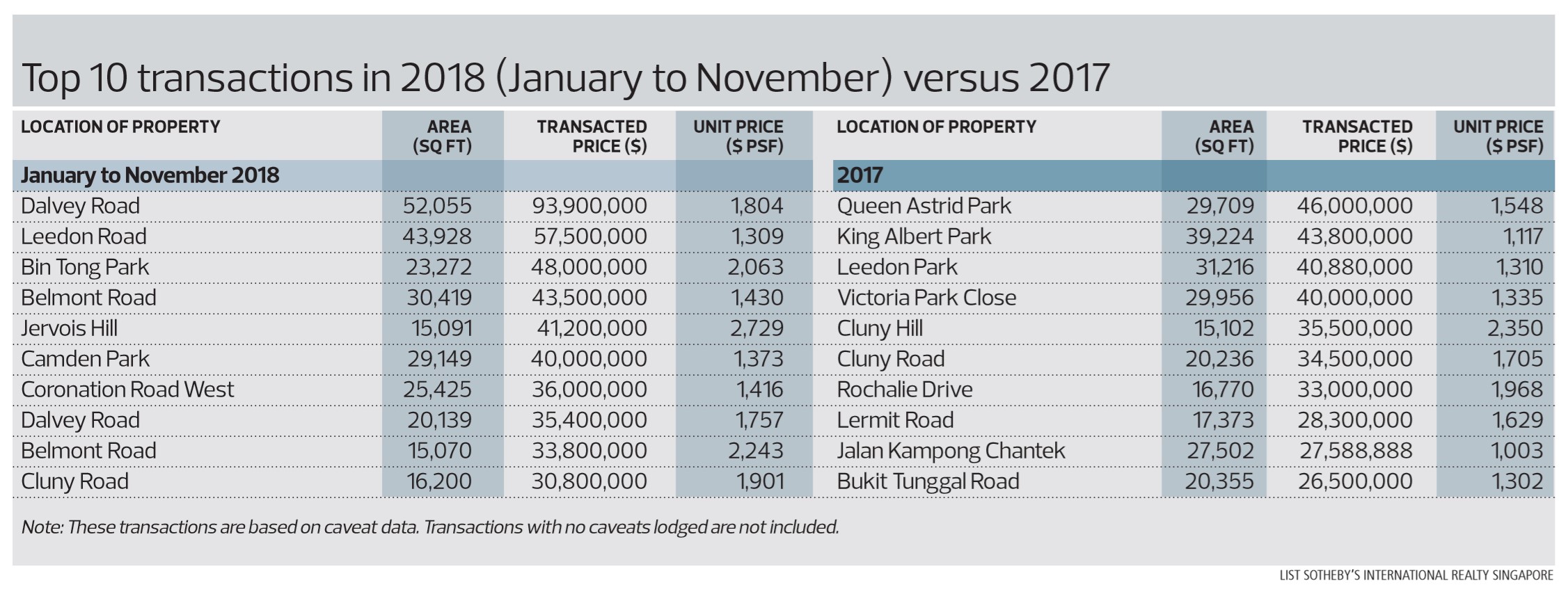

Of the top 10 GCB sales by absolute prices this year, at least five changed hands in the months following the July cooling measures, according to data from URA and List SIR.

A prominent sale is that of a GCB on Dalvey Road in the White House Park GCB area. It is the most expensive GCB transacted this year, according to caveats lodged with URA Realis. The GCB was sold for $93.9 million ($1,804 psf) in September, just two months after the latest property cooling measures. The house sits on an elevated land area of 52,055 sq ft at one of the highest points in the estate, and was home to one of Singapore’s founding fathers, the late Lim Kim San. The GCB belonged to the estate of Lim, who was also the first chairman of the HDB and oversaw the early development of public housing in Singapore.

A house on Dalvey Road changed hands for $93.9 million ($1,804 psf) in Sept, and is the most expensive GCB sold this year (Credit: JLL)

On July 20, a 30,419 sq ft GCB on Belmont Road in the Belmont Park GCB area was sold for $43.5 million ($1,430 psf). A 15,070 sq ft GCB in the same area changed hands a month later, fetching $33.8 million ($2,243 psf) when it was sold on Aug 28.

Among the top 10 GCBs sold this year were a 29,149 sq ft house on Camden Park in the Camden Park GCB area, which fetched $40 million ($1,373 psf) on Sept 22; and a 16,200 sq ft house on Cluny Road in the Cluny Park GCB area, which was sold for $30.8 million ($1,901 psf) on Nov 23.

GCBs are restricted properties and coveted by foreigners. Some of the recent purchases were by newly minted Singapore citizens from China, Taiwan and India, as well as selected permanent residents who have obtained approval to purchase from the Land Dealings Approval Unit of the Singapore Land Authority. The typical profile of GCB buyers tends to be UHNW families involved in the real estate, fashion, F&B, engineering and construction businesses, says Leong.

This GCB on Belmont Road fetched $33.8 million ($2,243 psf) when it was sold in August (Credit: Samuel Isaac Chua/The Edge Singapore)

Six of the top 10 GCB deals have either reached or exceeded $40 million in purchase price (see table). Last year, only four of the top 10 GCB deals managed to either hit or cross this threshold.

For the 39 GCBs sold by end-November, the average land rate translates into $1,509 psf, or 13.6% higher than the average land rate of $1,329 psf for the 42 GCBs sold last year, according to List SIR. This is because most of the GCBs sold this year either occupied larger plots or were newly built, says Leong.

For instance, a newly built bungalow on a 15,091 sq ft site on Jervois Hill in the Chatsworth Park GCB area commanded a sale price of $41.2 million, or $2,729 psf — an all-time high psf price achieved for a GCB transacted.

The sale of this house on Jervois Hill in June at $2,729 psf achieved an all-time-high psf price for a GCB

For next year, Leong expects more big-plot GCBs to be sold, “as there are investors who are looking to buy such trophy assets”. Owners tend to be discreet when putting up their properties for sale, and most have the holding power to wait for a suitable offer, he says.

Leong also expects the GCB segment to “maintain a similar level of performance” in terms of the number of deals as the past two years.

https://www.edgeprop.sg/tags/gcbs